About Wage Code

The government has integrated 29 central labor laws, including those regulating salaries and social security, into four wage codes. The latest codes contain components such as minimum pay, dearness, retaining, and special allowances in the calculation of ‘wages.’ Relevant elements such as HRA, conveyance statutory bonus, overtime allowance, and commissions have been removed from the calculation of salaries, which must account for at least 50% of overall remuneration under the code.

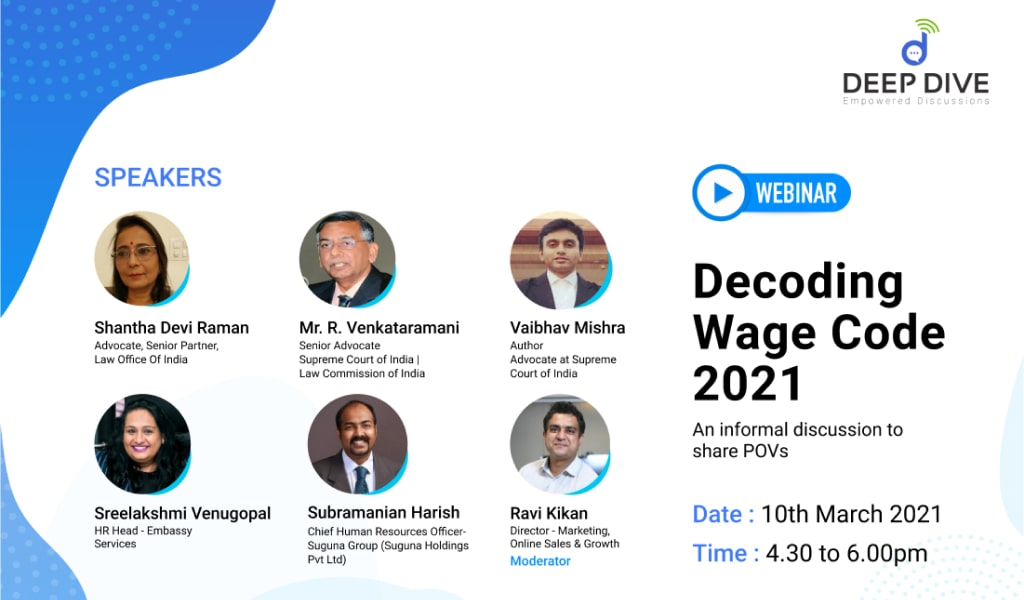

In our panel

We had Shantha Devi Raman | Advocate, Senior Partner, Law Office Of India |

She is a Lawyer with a rich experience of over 30 years in corporate & commercial advisory, employment & labour litigation and arbitration. She is a Senior Partner of Law Offices of India.

“There are 4 codes which have been enacted, which has replaced 23 statues. We need to understand what was the purpose of these codes. Was it only to consolidate? Or was it only to bring uniformity? Because earlier in each statue there were different definitions, different interpretations & hence different judgments, as a result there was much confusion with employers. So now what is the purpose: To bring only uniformity ? Or bring major amendments to suit present situations. IMO, it definitely does all of the above.”

The second member on the panel discussion was

Mr. R. Venkataramani | Senior Advocate, Supreme Court of India | Law Commission of India |

Mr. R. Venkataramani, started his legal career in 1978 in Puducherry, and moved to Delhi in 1979 to work under the Late Padma Bhushan Mr. P. P. Rao, Senior Advocate. Mr. Venkataramani was designated as a Senior Advocate by the Supreme Court in 1997.

“Before we decode the wage code, I was trying to understand the sum total of all exercises of these 4 codes? What was the parliamentary intention to put these all together? I don’t think there is a real breakthrough on certain fundamental issues, but there are some brighter elements in these codes, mainly the welcome aspects for the contract workers, reduction period in respect of calculation of gratuity etc is very important.”

Our third panelist was

Vaibhav Mishra | Author / Advocate at Supreme Court of India |

Vaibhav Mishra is an Advocate practicing in Supreme Court of India, Delhi High Court and Delhi District Courts. He currently work as a Senior Associate at C&C Associates, Advocates & Solicitors and appear & argue across all courts and forums. He has appeared previously on behalf of Delhi Development Authority (‘DDA’) in Delhi High Court.

“In a dispute resolution platform: what can the wagecode impact be.Can this wagecode have an impact on other dispute tribunals ? We know that an employee/ex-employee can go to NCLT under the insolvency bankruptcy act, to recover his due payments & his salaries. So what impact could this wage code have. Can this be used as a tool by the employee or by the company . I want to specifically touch upon the dispute resolution & litigation part of it.”

We had Sreelakshmi Venugopal | HR Head – Embassy Services| as our fifth panelist

Ms.Sreelakshmi Venugopal is the Head of Human Resources, at ESPL. An experienced HR professional with a career spanning about two decades, Sree plans, develops and implements human resource initiatives that align with organisational values and goals.

Subramanian Harish | Chief Human Resources Officer- Suguna Group (Suguna Holdings Pvt Ltd) | was our sixth panelist in the discussion.

Over 19+ years of experience working across diverse industries (European and Indian MNCs) in driving HR strategy, OD interventions, cultural transformations, Leaderhip development, leadership coaching, building HR Capability, Recruitment, Driving HR Shared services, Training & Organisation Development, HR Operations, Policy formulations and driving the organization growth through people excellence.

The discussion on Decoding Wage Code 2021 was moderated by Ravi Kikan | Director – Marketing, Online Sales & Growth |

His experience in Startups and Enterprise sectors like Media & PR, Fintech, Education, Digital, Retail, Mobile, Healthcare, AI, iOT, Tech, e-Commerce, Real Estate has helped him to launch & grow ventures. The author of one of the best loved books for startups and entrepreneurs How To Validate Your Startup Business Idea. He even engages with educational institutions to talk to the students about how to prepare for the next step, Future of Work, Digital Transformation, Technology disruption and Change Management.He enjoys working with entrepreneurs, enterprises, community builders and investors who are focused at growth.

Have been part of startups with successful exits by leading startup operations in a CXO role. Currently he is the Director Marketing, Growth and Online Sales.

ZingHR’s Outcome is future-ready for the implementation of the Wage Code

While the Wage Code will be implemented by organisations from 1 April 2021 or later, we already have some very progressive clients who have gone ahead with the implementation of the ZingHR Outcome Model in accordance with the provisions of this new Wage Code.

The rationale advocated by People Practices Advisory is that the Wage Code is a major reform of the four Labor Codes being introduced with fiduciary implications.

Principal employers – which make up the majority of the enterprise segment will need to ensure that their contractors submit invoices for the wages paid to their labour on time so that they are contract labour receive wages on time.

Our team, supported by our legal experts, will be able to extend services to organisations, especially those with a fair mix of on-the-roll and off-roll employees.

The Super Solution by ZingHR

- Zing HR Outcome is future-ready for the effective implementation of the New Wage Code.

- While the New Wage Code will be properly implemented by organisations from 1 April 2021 or later, we at present made progressions with clients who have gone ahead with the implementation of the ZingHR Outcome Model following the provisions of the New Wage Code.

- The rationale advocated by People Practices Advisory is that the New Wage Code is a vital reform of the four Labor Codes being introduced with fiduciary implications.

- This typically means that the readiness for implementation must be immediately initiated. This will undoubtedly help to minimise the economic impact on household salaries, etc. When the successful HR Tech transition of the payroll system is incorporated and ready in economic advance.

- All labour service providers will have to produce an accurate wage declaration to be sent to the leading employer so that employees who engage in it can be paid in due time.

- Our team, supported by our forensic experts, will be able to graciously extend services to organisations, especially those with a fair mix of on and off Pay-roll employees.